The residential energy credits are.

Federal investment tax credit solar form.

You calculate the credit on the form and then enter the result on your 1040.

If you checked the no box you cannot claim the nonbusiness energy property credit.

Use this form to claim the investment credit.

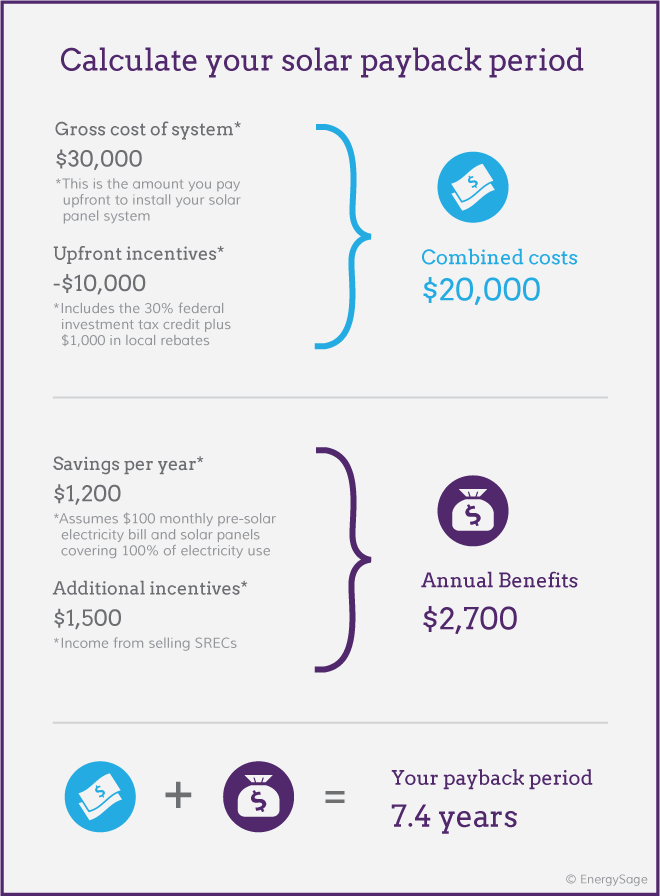

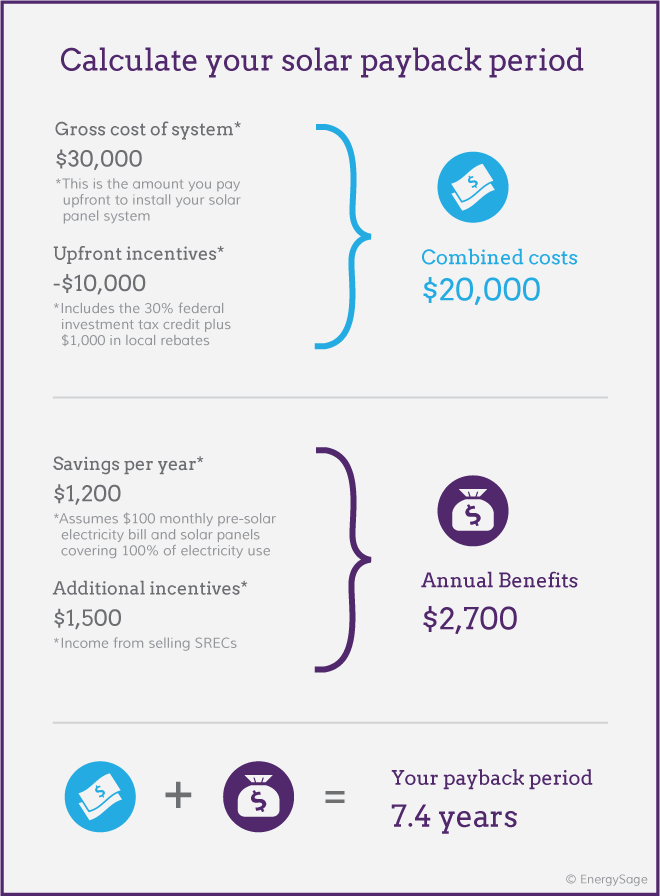

For example if your solar pv system was installed before december 31 2019 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would be calculated as follows.

If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs.

The solar investment tax credit itc is a tax credit that can be claimed on federal corporate income taxes for 30 of the cost of a solar photovoltaic pv system that is placed in service during the tax year 1 other types of renewable energy are also eligible for the itc but are beyond the scope of this guidance.

Information about form 3468 investment credit including recent updates related forms and instructions on how to file.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

0 3 18 000 5 400 state tax credit.

Qualified investment in qualified gasification property placed in service during the tax year for which credits were allocated or reallocated after october 3 2008 and that includes equipment that separates and sequesters at least 75 of the project s carbon dioxide emissions 30 0 30 6a b.

Do not complete part ii.

Use form 5695 to figure and take your residential energy credits.

To claim the credit you must file irs form 5695 as part of your tax return.

The investment credit consists of the following credits.

Qualified investment in property other than.